My sister did some serious shopping in Rome when she was here in April, not so much for herself but for others who had given her a list of things to buy. This post was written by her about the arduous steps to take in order to get the tax refund.

Here’s a “quick” or “simple” a post as possible to hopefully simplify and make the quite tedious process of getting the tax refund in Rome. As you most likely know, the tax (VAT) refund is only applicable for non-EU residents.

As you can see, it’s a fairly long post but worth reading if your intention is to get the refund – an amount which can be end up being significant.

Shopping in Rome – Tips to get your tax refund

The key tip is: Don’t Give Up!

Perhaps they had purposely made it difficult to figure how to get the tax refund, but once you get an idea of what you are supposed to do, it’s pretty simple. I can’t believe I’m saying that because I was infruriated by the process and almost gave up thinking it wasn’t worth it. But I left almost US $200 happier.

Disclaimer: This was accurate at the time of writing and we do not take any responsibility what so ever if there are any changes to the process from what is outlined below. In addition, we are not responsible for any inaccuracy.

From my own experience, I have been quite upset at a few sites who try to explain the process and were not thorough. So I would like to give this caveat to avoid any upset feelings.

How to get the tax refund:

1. It’s best to always carry your passport with you or have your passport details written down as you need this information at the time of payment. These details have to be entered into the form at the store where the purchased is made.

2. Types of Tax Free Services

I only encountered three types of Tax Free Services

3. When shopping in Rome, you have to spend at least $155 euro at the same store to qualify for the tax refund. Then at the cashier inform them you want the tax refund.

They will bring out one of the forms of the tax free services as mentioned above and fill in your details. You don’t have to worry about selecting the tax free service as they usually only have one depending on the store.

4. If you can get a few tax refunds in Rome centre, do it and don’t wait to do it at the airport. It will speed things slightly.

The easiest is Global Blue. They have a store location next to the Pantheon and another location on Via Del Corso, close to Piazza Venezia.

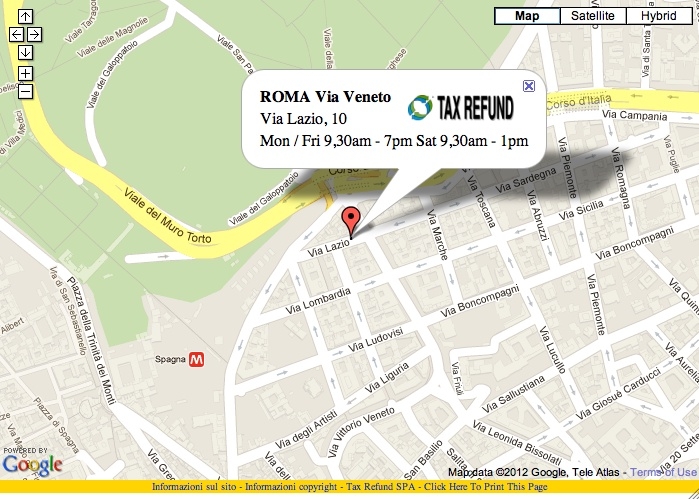

Tax Refund for Tourist was also relatively easy but I didn’t know they had a location in Via Veneto so I waited until we were at the airport to claim the tax refund. As such, I can’t vouch whether you can truly get a tax refund at the location.

The most misleading is Premier Tax Free. They have a location close to Piazza Spagna.

Basically you have to walk up the long flight of stairs at Piazza Spagna, followed by going down this long long windy lane that looks pretty deserted and abandoned. You would then enter this doorway that looks like you’re walking into the lair of the Volteri in the movie Twilight.

Imagine how mortified I got there just to be told that “you that you have to go to the airport to get the Customs Duty stamp and return back to the office to get the cash”. Otherwise just do it at the Airport!

5. Getting the Cash Refund. Please note they will give you the refund in US dollars.

Just keep the US dollars because if you exchange it into Euro again then you’re losing out again on the currency exchange. If you don’t live in the US, you are still be better off keeping the US dollars and finding a good currency exchange place in your country to get local currency.

6. Whether you get the cash refund at the locations in Rome Centre or at the Airport, you still need to go to the Tax Free services counter to get the Customs Stamp. So why did we tell you above to get the refund in Rome Centre when you still have to go to the counter at Rome Airport? It’s because you do save a bit of time of them having to calculate and count out the cash.

7. Packing before your head to the airport. Decide if you want to hand carry the tax free goods in your hand carry baggage or check in the tax free goods in your check in baggae., We explain below. Pack your tax free goods if you can in one shopping bag that you can easily remove from your luggage. This is because they will want you to show them all the goods at the counter.

GIVE YOURSELF A LOT OF TIME A GOOD 1HR FOR THIS PROCESS. SO IF YOU HAVE TO CHECK IN 2HR BEFORE YOUR FLIGHT THEN GET THERE AT LEAST 3HRS BEFORE. Also many have written that if you do take the “check in baggage option”, it could take even longer so if possible, opt for the “hand carry” option.

8. Once at the airport:

DO NOT GO TO THE CUSTOMS COUNTER FIRST. GO CHECK IN TO YOUR FLIGHT FIRST. We explain why below.

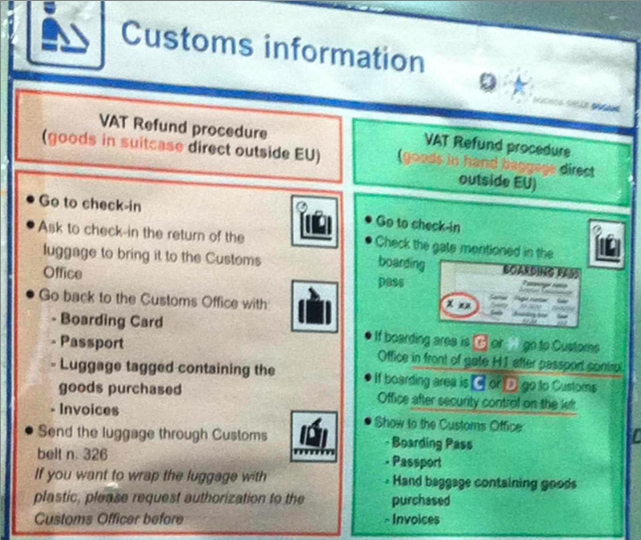

Here’s the Customs instruction for the Tax Free Refund:

Hand Carry option and Check in Baggage Option

If you have the goods in your suitcase, check-in for your flight first and then bring the luggage to customs. We saw people who waited in line at Customs only to be told they had to check in first! Imagine the amount of time lost!

Hand Carry option depends on your gate number and you may be required to walk a good distance to get your tax free refund.

So it depends on your preference and how much time you have to decide how you want to carry your tax free goods.

Here’s the map of the Customs counter at the Check in Area (if you decided to check in your tax free goods)

9. Then once you’re at the counter give them the forms and get the custom duty stamps. If you haven’t already, go get your refund.

10. IMPORTANT: Now you also have to mail the forms with the custom stamp in the mailboxes that are conveniently located next to the counters.

I thought to myself at first if I already received my cash why do I need to mail the forms again? Well, the following is written on the envelope:

If Global Blue does not receive the Tax Refund Cheque within 21 days (from the date of issue) duly stamped by EU customs, you will be charged onto your credit card for the VAT amount plus a commission.

I’m still somewhat confused about this because I think it’s only applicable if you haven’t received your cash refund. Also what if you pay cash then perhaps this is not applicable either. Anyways to be safe rather than sorry just drop it into the mail box.

Have you ever gone through the process of getting a tax refund? What was your experience like? Also, if you have any additional tips, please feel free to share it with us in the comments section below.

Have fun shopping in Rome!

BrowsingRome Blogging about my experiences and sharing my thoughts about Rome, Italy and beyond

BrowsingRome Blogging about my experiences and sharing my thoughts about Rome, Italy and beyond